Introduction

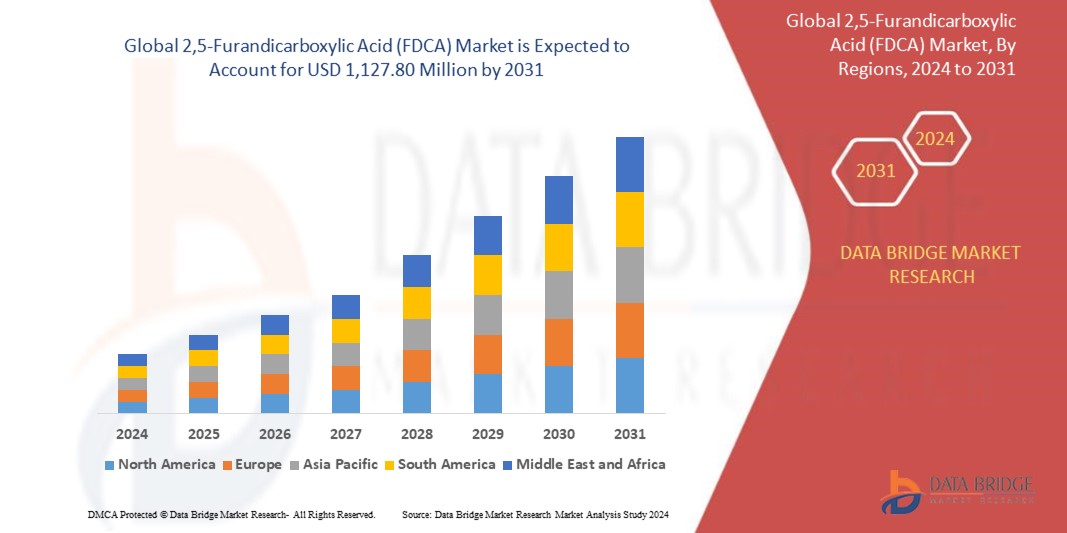

The 2,5-Furandicarboxylic acid (FDCA) is a bio-based chemical derived primarily from fructose and other renewable carbohydrates. It has attracted significant attention as a sustainable alternative to petroleum-derived terephthalic acid (PTA) because it can be polymerized into polyethylene furanoate (PEF), a next-generation polyester with properties that rival or exceed those of PET (polyethylene terephthalate). As global industries push toward circularity and lower carbon footprints, FDCA’s role as a renewable building block for high-performance polymers, coatings, adhesives, and specialty chemicals positions it as a strategic material in the green chemicals transition.

Market Drivers

-

Sustainability and Regulatory Pressure: Governments and corporations are increasingly setting targets to reduce greenhouse gas emissions and increase the use of renewable feedstocks. FDCA—derived from biomass—helps manufacturers meet sustainability goals and regulatory requirements (EPR, recycled content mandates, carbon reporting), driving demand.

-

Performance Advantages of PEF: When polymerized to PEF, FDCA-based polymers offer superior barrier properties (notably oxygen and CO₂ barrier) and mechanical strength compared to PET. These properties are highly attractive for packaging, especially for beverages and food where shelf life and reduced preservatives are valuable.

-

Rising Demand for Bio-based Polymers: Consumer preference and brand commitments to sustainable packaging are accelerating adoption of bio-based polymers. Major CPG and beverage companies exploring alternatives to PET create substantial downstream demand for FDCA.

-

Technological Maturation: Advances in catalytic conversion, fermentation routes, and process intensification have reduced production costs and improved yields in many pilot and demonstration projects, making commercial FDCA more feasible.

Discover how the 2,5-Furandicarboxylic Acid (FDCA) Market is changing with key trends and forecasts. Access the report:

https://www.databridgemarketresearch.com/reports/global-fdca-market

Market Restraints

-

Feedstock Competition and Price Volatility: FDCA production typically depends on sugar feedstocks (fructose, HMF intermediates). Competition with food supply chains and volatility in agricultural commodity prices can affect economics.

-

Scale and Cost Parity with PTA: PTA benefits from mature, high-volume supply chains and low costs due to petrochemical scale. FDCA producers must reach significant scale, optimize catalysts, and secure low-cost feedstock to compete on price without subsidies.

-

Infrastructure and Compatibility: While PEF is promising, existing recycling streams and conversion infrastructure are optimized for PET. Widespread adoption requires investments in sorting, recycling compatibility assessments, and industrial-scale polymerization capacity.

-

Market Education & Certification: Brands and converters require robust life-cycle assessments, certification (e.g., ISCC, other mass-balance schemes), and long-term supply assurances to shift procurement to FDCA-based materials.

Market Segmentation

-

By End-Use Industry

-

Packaging (bottles, films, trays)

-

Textiles and fibers

-

Automotive (lightweight interior components, coatings)

-

Electronics (encapsulation, specialized films)

-

Specialty chemicals & resins

-

-

By Product Form

-

Monomeric FDCA (purified acid)

-

Dimethyl furan-2,5-dicarboxylate (DMFD) and other esters (intermediates used in polymerization)

-

Polymerized products (PEF and blends)

-

-

By Production Technology

-

Catalytic oxidation of HMF

-

Biocatalytic/enzymatic routes

-

Hybrid chemical-biological processes

-

-

By Geography

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

-

Regional Dynamics

-

Europe: Strong policy support for bio-based materials, ambitious circularity goals, and a concentration of innovative chemical companies make Europe a leading adopter. Regulatory frameworks and consumer pressure favor sustainable packaging pilots and rollouts.

-

North America: Growing interest from beverage and CPG companies combined with venture funding have enabled demonstration plants and partnerships. Feedstock availability and innovation hubs (biotech/catalysis) are assets.

-

Asia-Pacific: A mix of strong manufacturing capability and large food & beverage markets creates demand potential. However, uptake depends on cost competitiveness and localized production to avoid long supply chains.

-

Rest of World: Emerging markets may adopt FDCA indirectly through imports of FDCA-derived polymers or packaging made elsewhere until local infrastructure and economics improve.

Key Trends

-

Industrial Partnerships & Joint Ventures: To reach commercialization, many FDCA developers are partnering with polymer producers, beverage companies, and chemical majors to secure offtake agreements and accelerate scale-up.

-

Integration Along Value Chain: Vertical integration—from feedstock sourcing (biorefineries) to polymerization and packaging manufacturing—reduces margin leakage and improves supply reliability.

-

Focus on Low-Cost Feedstocks: Research into lignocellulosic sugars, waste-sugar streams, and alternative biomass aim to reduce feedstock costs and avoid competition with food.

-

Recycling & Circularity Pilots: Pilots assessing PEF recyclability, mono-material packaging systems, and compatibility with existing recycling infrastructure are proliferating. Closed-loop programs with brand partners are a priority.

-

Novel Applications Beyond Bottles: Due to its barrier and thermal properties, PEF is being explored for high-value films, specialty fibers, and even electronic component encapsulation where PET is not ideal.

Opportunities for Stakeholders

-

Investors: Early investments in FDCA producers and downstream PEF converters can capture value as commercialization scales. Look for companies with strong feedstock strategies and offtake agreements.

-

Chemical Companies & Converters: Licensing polymerization technology and forming strategic supply agreements can secure early mover advantages in bio-polyester markets.

-

Brands (CPG/Beverage): Piloting FDCA-based packaging allows brands to differentiate and meet sustainability commitments; long-term contracts can also help stabilize supply and prices.

-

Technology Providers: Catalysis, enzyme providers, and process engineering firms can monetize improvements that reduce conversion costs and increase yield.

Challenges to Watch

-

Price Competition: Unless policy incentives, carbon pricing, or substantial process efficiencies shift economics, raw FDCA/PEF may remain more expensive than PET for many commodity uses.

-

Standards & Certification: Industry-recognized standards for bio-based content, recyclability, and LCA transparency are still evolving—companies must navigate emerging certification landscapes.

-

Scale-Up Risk: Transitioning from pilot to commercial scale brings engineering, quality, and regulatory hurdles; not all ventures will succeed.

Future Outlook

The FDCA market is poised for growth as sustainability priorities and material performance align. Short-term growth will likely be concentrated in high-value packaging (premium beverage bottles, specialty films) and niche industrial applications where superior barrier or thermal properties justify a price premium. Over the medium term, cost reductions from scaled production, improved feedstock sourcing, and supportive policies (bio-content mandates, carbon credits) could expand FDCA’s addressable market into broader beverage and consumer packaging segments. Achieving integration with recycling systems and proving circularity at scale will be critical to long-term market penetration.

Conclusion

FDCA represents a strategically important bio-based building block with the potential to displace a portion of petroleum-based PTA in high-value polyester applications. The combination of environmental benefits and competitive material properties positions FDCA as a leading candidate for enabling low-carbon packaging and specialty polymer markets. Success will depend on continued technological improvements, smart partnerships across the value chain, feedstock strategy, and the evolving policy landscape that can tilt economics in favor of renewable chemicals. For stakeholders—from investors to brands—FDCA offers an attractive but execution-intensive opportunity in the transition to a more sustainable materials economy.

Browse More Reports:

Middle East and Africa Polyether Ether Ketone (PEEK) Market

North America Protective Gloves Market

Middle East and Africa Protective Gloves Market

Europe Radiology Services Market

New Zealand Radiology Services Market

U.K. Radiology Services Market

Europe Refrigerant Market

North America Refrigerant Market

Middle East and Africa Stevia Market

North America Stevia Market

Europe Surgical Robots Market

Global Achromatopsia Treatment Market

Global Acrylamide Monomer Market

Global Acrylic Coating Additives Market

Global Activated Carbon Filters Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience, which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com