"Executive Summary Personal Gadget Insurance Market :

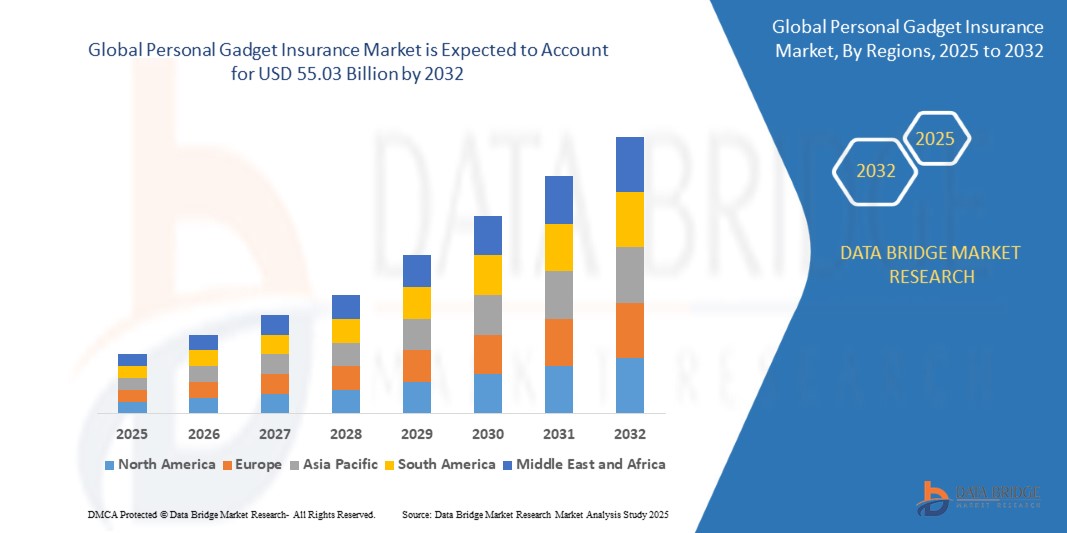

The global personal gadget insurance market size was valued at USD 25.30 billion in 2024 and is projected to reach USD 55.03 billion by 2032, with a CAGR of 10.20% during the forecast period of 2025 to 2032

The global Personal Gadget Insurance Market report supports to establish and optimize each stage in the lifecycle of industrial process that includes engagement, acquisition, retention, and monetization. This market report encompasses the study about the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, possible future trends, and market demand and supply scenarios. This market research report provides a comprehensive study on production capacity, consumption, import and export for all major regions across the world. Thus, the report aids to concentrate on the more important aspects of the market.

The information, statistics, facts and figures delivered via this report supports companies in industry to maximize or minimize the production of goods depending on the conditions of demand. Personal Gadget Insurance Market report comprises of data that can be very much essential when it is about dominating the market or making a mark in the market as a new emergent. Besides this, it categorizes the breakdown of global data by manufacturers, region, type and application, and also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Personal Gadget Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market

Personal Gadget Insurance Market Overview

**Segments**

- Based on type, the personal gadget insurance market can be segmented into mobile phones, laptops, tablets, and others. Mobile phones account for a significant share due to the high penetration of smartphones globally and the costly nature of replacing or repairing them.

- On the basis of application, the market can be categorized into personal and commercial use. Personal use dominates this market segment as individuals seek to protect their personal gadgets against accidental damage, theft, or other unforeseen events.

- Geographically, the global personal gadget insurance market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is poised for significant growth due to the increasing smartphone penetration and rising disposable incomes in countries like China and India.

**Market Players**

- Some of the key players in the global personal gadget insurance market are Allianz Insurance, AmTrust Financial Services, Apple Inc., Asurion, Assurant, Inc., AXA, Brightstar Corp., Hollard Group, HomeServe, and Liberty Mutual. These players engage in strategies such as product innovation, partnerships, and mergers & acquisitions to strengthen their market presence and expand their customer base.

https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market The personal gadget insurance market continues to witness growth driven by the increasing reliance on electronic devices globally. As technological advancements continue to evolve, the need to protect these gadgets from potential risks such as damage, theft, or malfunction becomes paramount. The segmentation of the market by type highlights the varying preferences of consumers when it comes to insuring their gadgets. Mobile phones command a significant market share, reflecting the ubiquitous presence of smartphones in today's society and the substantial financial investment associated with these devices. Laptops, tablets, and other gadgets also contribute to the market, catering to the diverse needs of consumers with different types of gadgets.

Furthermore, the segmentation based on application sheds light on the distinct purposes for which personal gadget insurance is sought. While personal use remains the dominant segment, commercial applications are also gaining traction as businesses equip their employees with various gadgets for work-related tasks. This shift underscores the importance of mitigating risks associated with business-owned devices, ensuring continuity and efficiency in operations.

Geographically, the global personal gadget insurance market exhibits varying degrees of growth potential across different regions. Asia Pacific emerges as a key growth market, driven by the increasing adoption of smartphones in countries like China and India. The rising disposable incomes in these regions further fuel the demand for personal gadget insurance, as consumers seek to safeguard their valuable devices against unforeseen events. North America and Europe, being mature markets, continue to witness steady growth fueled by the presence of established players and a tech-savvy consumer base.

In terms of market players, a competitive landscape characterizes the personal gadget insurance market with a mix of global insurance providers, technology companies, and specialized insurers. Companies such as Allianz Insurance, Apple Inc., and Assurant, Inc. leverage strategies like product innovation and strategic partnerships to enhance their market position and cater to evolving consumer needs. As the market continues to evolve, collaborations and mergers & acquisitions are expected to shape the competitive dynamics, with players vying for market share and differentiation through value-added services and tailored insurance solutions.

Overall, the personal gadget insurance market presents a lucrative opportunity for players to capitalize on the growing demand for device protection and insurance services. With technological advancements driving the proliferation of gadgets across personal and commercial sectors, the need for comprehensive insurance coverage is set to increase, creating avenues for market expansion and innovation in the coming years.The global personal gadget insurance market is poised for continued growth driven by the escalating reliance on electronic devices worldwide. This reliance has been further accentuated by the rapid pace of technological advancements, emphasizing the need for consumers to safeguard their gadgets from various risks such as damage, theft, or malfunctions. The market segmentation according to the type of personal gadgets being insured illustrates the diverse preferences of consumers. While mobile phones retain a significant market share due to their widespread usage and high replacement costs, laptops, tablets, and other gadgets also play a role in catering to the varying needs of consumers with different types of devices.

Moreover, the segmentation based on application highlights the evolving landscape of personal gadget insurance, with personal use currently dominating the market. However, there is a growing trend towards commercial applications as businesses equip their workforce with gadgets for operational efficiency. This shift underscores the critical need for mitigating risks associated with business-owned devices, thereby driving the demand for insurance services in the commercial sector as well.

Geographically, the market exhibits distinct growth dynamics across different regions, with Asia Pacific emerging as a key growth market due to the increasing smartphone adoption rates in countries like China and India. The rising disposable incomes in these regions further propel the demand for personal gadget insurance as consumers seek to protect their valuable devices. Mature markets such as North America and Europe continue to witness steady growth, supported by the presence of established players and tech-savvy consumer bases.

In terms of market players, the personal gadget insurance sector is characterized by a competitive landscape comprising global insurance providers, technology companies, and specialized insurers. Companies like Allianz Insurance, Apple Inc., and Assurant, Inc. are leveraging strategies such as product innovation and strategic partnerships to bolster their market positions and cater to evolving consumer needs. Collaborations and mergers & acquisitions are expected to shape the competitive dynamics as companies vie for market share and differentiation through tailored insurance solutions and value-added services.

Overall, the personal gadget insurance market presents an attractive opportunity for players to capitalize on the increasing demand for device protection and insurance services. With technological advancements driving the proliferation of gadgets in both personal and commercial settings, the need for comprehensive insurance coverage is set to grow, thereby creating avenues for market expansion and innovation in the foreseeable future.

The Personal Gadget Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-personal-gadget-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Personal Gadget Insurance Market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

- Competitive Assessment:In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

- Market Development:Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

- Market Diversification:Exhaustive information about new products, untapped geographies, recent developments, and investments in the Personal Gadget Insurance Market.

Browse More Reports:

Global Industrial Adhesives Market

Global Immune Health Supplements Market

Global High Potency API HPAPI Market

Global Hashimoto’s Thyroiditis Drug Market

Global Gluten-Free Snacks Market

Global Food Grade Paraffin Wax Market

Global Foam Glass Market

Global Fire Resistant Hydraulic Fluids Market

Global Electric Toothbrush Market

Global Elastic Laminates Market

Global Drug Delivery Market

Global Deodorization Systems Market

Global Connected Enterprise Market

Global Bladder Disorders Market

Global Birth Defects Market

Global Automotive Refinish Coatings Market

Global Aerobatic Aircraft Market

Global X-Arm Type Window Regulator Market

Global University Management System Market

Global Surgical Incision Closure Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Personal Gadget Insurance Market Size, Personal Gadget Insurance Market Share, Personal Gadget Insurance Market Trend, Personal Gadget Insurance Market Analysis, Personal Gadget Insurance Market Report, Personal Gadget Insurance Market Growth, Latest Developments in Personal Gadget Insurance Market, Personal Gadget Insurance Market Industry Analysis, Personal Gadget Insurance Market Key Player, Personal Gadget Insurance Market Demand Analysis"